Join Prop Firm

What is?

How to be Funded?

Your Guide To Learn What a Prop Trading Firm Is?

What is a Prop Trading Firm?

A Prop Trading Firm (short for proprietary trading firm) is a company that funds traders with the firm’s capital, rather than having them risk their own money. Traders who partner with a Prop firm can trade larger positions on the market, using the firm’s money to make profitable trades. In return, the firm takes a share of the profits, while the trader keeps the majority of their earnings. Prop firms offer a structured path to becoming a funded trader through a process called a trading challenge. This challenge is designed to assess a trader’s skills, discipline, and ability to manage risk effectively.

Example of How It Works?

Sing Up

You sign up for an Account Funding Challenge of $5,000 or more at Prop Firm for a small fee.

Challenge

During the challenge, you make consistent, responsible trades and hit your profit target while keeping your losses within the limits.

Funding

After passing the challenge, you receive a $5000 or more funded account, and now you can trade with real money.

Trade and Earn

You continue to trade with discipline, growing the account and keeping up to 90% of your profits.

Advantages of working with Prop Firm

“Proprietary trading forces you to adopt a professional approach to the financial markets.”

“Whether you’re a beginner or an experienced trader, this type of trading cultivates discipline, patience, and responsibility. The strict risk management policies that Prop firms enforce teach you to treat trading like a business rather than a gamble.”

How Does Prop Trading Work?

The process of becoming a funded trader is not difficult, now it is easy to apply in just a few steps.

1. Register for the Challenge

To begin, you must Sign Up for the trading challenge offered by the Prop firm. This usually involves paying a small fee, which allows you to access a simulated trading account where your performance will be monitored. The challenge is designed to test your ability to trade profitably while maintaining proper risk management.

What You’ll Need:

– A basic understanding of financial markets and trading strategies.

– The ability to manage your risk (limiting losses while maximizing potential gains).

– A plan for consistent and disciplined trading.

2. Pass the Challenge

During the challenge, you’ll be required to meet certain profit targets while adhering to strict risk limits. The firm will monitor key metrics like maximum daily loss, total drawdown, and risk-per-trade to ensure that you’re trading responsibly. The challenge phase is critical because it shows the Prop firm that you have the skill set and mindset to handle real capital.

Why This Matters:

– They are looking for disciplined traders, not those chasing quick profits without considering the risks.

– It’s not just about making money— it’s about proving that you can manage risk.

3. Become a Funded Trader

Once you’ve successfully completed the challenge, you’ll be awarded a real funded trading account. The capital in this account is provided by the Prop firm, allowing you to trade larger positions than you would on your own. The profit split is highly favorable for traders, often allowing you to keep up to 90% of your profits, while the Prop firm takes a smaller percentage.

What You Gain:

– Access to significant capital, enabling you to take larger positions and potentially earn more profits.

– Zero personal risk to your own savings, as you’re trading with the firm’s funds.

4. Trade and Earn Profits

As a funded trader, your goal is to continue trading profitably while following the risk guidelines set by the Prop firm. You can withdraw your earnings, and as long as you maintain discipline, you can continue trading with the firm’s capital indefinitely.

Why This Is Powerful:

– The more disciplined and successful you are, the more capital you can access from the firm.

– It’s a win-win: you trade confidently without risking your own money, and the Prop firm profits from your success.

FundedBull Review

4.7/ 5

509 raitings

FundedBull is tailored to meet the needs of all kinds of traders, offering several account types and funding amounts that range from $5,000 to $250,000. One of the firm’s standout features is its low profit target—just 6%—making it more achievable for traders to hit their objectives. Platforms like MetaTrader and cTrader give you access to advanced trading technologies to sharpen your skills.

When it comes to trust and security, FundedBull partners with regulated brokers and liquidity providers. This ensures tight spreads and a high level of fund safety. With positive feedback from users, the firm is gaining a reputation for being reliable and supportive of traders. Keep reading to explore more of what FundedBull has to offer.

Key Takeaways

- FundedBull provides a 90% profit split and a low 6% profit target.

- The firm offers multiple trading platforms and a variety of funding options.

- Regulated liquidity providers ensure secure trading and tight spreads.

Read more

Your Path to Financial Freedom with Prop Trading

FundedBull is a leading Prop Firm in the market, offering innovative solutions for traders of all skill levels and trading styles. Established by financial experts with extensive experience in the markets, FundedBull provides a solid platform for risk management In this review, we’ll explore the main features of their challenges and overall offering.

Trader Opportunities: Three Challenge Options

One of FundedBull’s biggest strengths is the flexibility offered by three distinct challenge types, catering to traders with different strategies and risk tolerance levels.

One-Step Challenge

Designed for traders who can showcase their skills in a single evaluation phase, this challenge features higher profit targets and stricter drawdown limits, making it ideal for aggressive trading styles.

Key Parameters:

Profit Target: 9%

Trading Period: Unlimited

Minimum Trading Days: 5 days

Maximum Drawdown: 6%

Two-Step Challenge

This option offers a more balanced approach, suitable for traders with a moderate risk profile. It involves two phases of evaluation, allowing traders to reach their goals progressively.

Key Parameters:

Phase 1 Profit Target: 8%

Phase 2 Profit Target: 5%

Trading Period: Unlimited

Minimum Trading Days: 5 days

Maximum Drawdown: 8%

Three-Step Challenge

For traders who prefer a more conservative and measured approach, the three-step challenge is ideal. It focuses on risk management and gradual growth in profits.

Key Parameters:

Phase 1 Profit Target: 6%

Phase 2 Profit Target: 6%

Phase 3 Profit Target: 6%

Trading Period: Unlimited

Minimum Trading Days: 5 days

Maximum Drawdown: 7%

Payout Structure: Fast and Transparent

FundedBull stands out with its generous profit-sharing model, where traders retain 90% of the profits, while the remaining 10% goes to the company. This is an attractive offer for successful traders looking to maximize their earnings. Furthermore, payouts are processed within 7 days, ensuring prompt and reliable access to your profits.

Trading Platforms and Technical Advantages

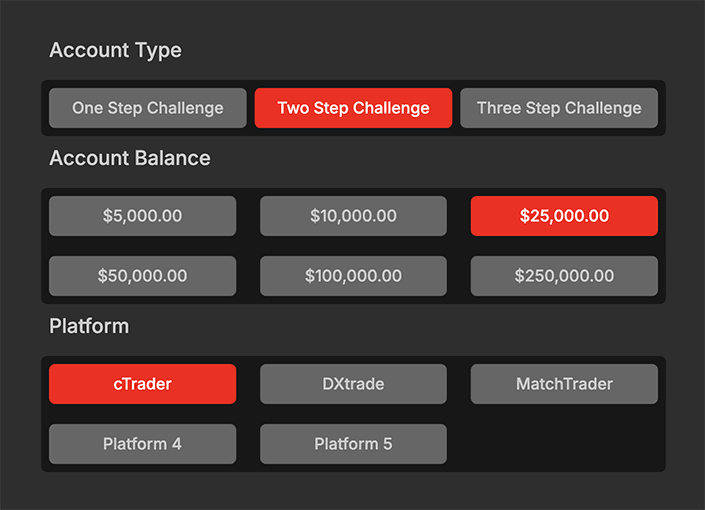

FundedBull provides traders with access to a variety of trading platforms, including some of the industry’s most popular: cTrader, DXtrade, MatchTrader, MetaTrader 4, and MetaTrader 5. This wide selection allows traders to work with their preferred tools, ensuring efficiency and comfort. The platforms are known for their intuitive interfaces and speed, a significant advantage for active traders who require dependable, fast execution.

The customer support at FundedBull also receives high marks. Clients report fast response times and helpful assistance, making traders feel supported and secure in their trading journey.

Conclusion

FundedBull combines the expertise of seasoned financial professionals with innovative trading solutions for traders at any level. Whether you are an aggressive trader seeking rapid returns or a conservative trader focused on risk management, FundedBull has a challenge tailored to your needs. Additionally, the firm’s profit-sharing structure and available platforms make it highly competitive in the prop trading space.

If you’re looking for a prop firm with flexible conditions, high profit retention, and top-tier support, FundedBull is an excellent choice. With their diverse challenge options and transparent conditions, traders have the opportunity to unlock their full potential.

Take the Leap Towards Becoming a Funded Trader

Unlock access to significant trading capital without risking your own money. Tailor your potential funding size and evaluation steps. Join the FundedBull Challenge today and prove your trading skills. Pass the challenge and start trading with up to $250,000 in firm capital, keeping up to 90% of your profits! Don’t wait—start your journey now and make your trading potential a reality.

How to become a trader in FundedBull?

1.

Choose what type of challenge account you want to apply for based on your experience or capabilities?

2.

Choose what funding you want to receive by choosing from a $5,000 to $250,000 funded account?

3.

Choose which platform you want to trade with; cTrader, DXtrade, MatchTrader, MetaTrader 4 and 5?

Account Types of Challenge

When you select the challenge, you can proceed to complete your order.

One Step Challenge

The challenge is designed for traders who can demonstrate their skills in a single evaluation phase. This challenge has higher profit targets and tighter drawdown limits, making it suitable for more aggressive trading styles.

Rule:

Profit Target: 9%

Trading Period: Unlimited

Min. Trading days: 5 days

Maximum Drawdown: 6%

Daily Drawdown Limit: 3%

Leverage: 50:1

Drawdown Type: Trailing

Max. Inactivity Period: 15 days

Two Step Challenge

The challenge involves a more moderate approach, with profit targets and drawdown limits that provide a balance between risk and reward. This challenge is suitable for traders with an average risk profile.

Rule:

Phase 1 Profit Target: 8%

Phase 2 Profit Target: 5%

Trading Period: Unlimited

Min. Trading days: 5 days

Maximum Drawdown: 8%

Daily Drawdown Limit: 4%

Leverage: 50:1

Drawdown Type: Static

Max. Inactivity Period: 15 days

Three Step Challenge

The challenge is designed for conservative traders who prefer a more gradual approach. This challenge is ideal for traders who prioritize risk management.

Rule:

Phase 1 Profit Target: 6%

Phase 2 Profit Target: 6%

Phase 3 Profit Target: 6%

Trading Period: Unlimited

Min. Trading days: 5 days

Maximum Drawdown: 7%

Daily Drawdown Limit: 4%

Leverage: 50:1

Drawdown Type: Static

Max. Inactivity Period: 15 days